Getting Started

Areas of Interest

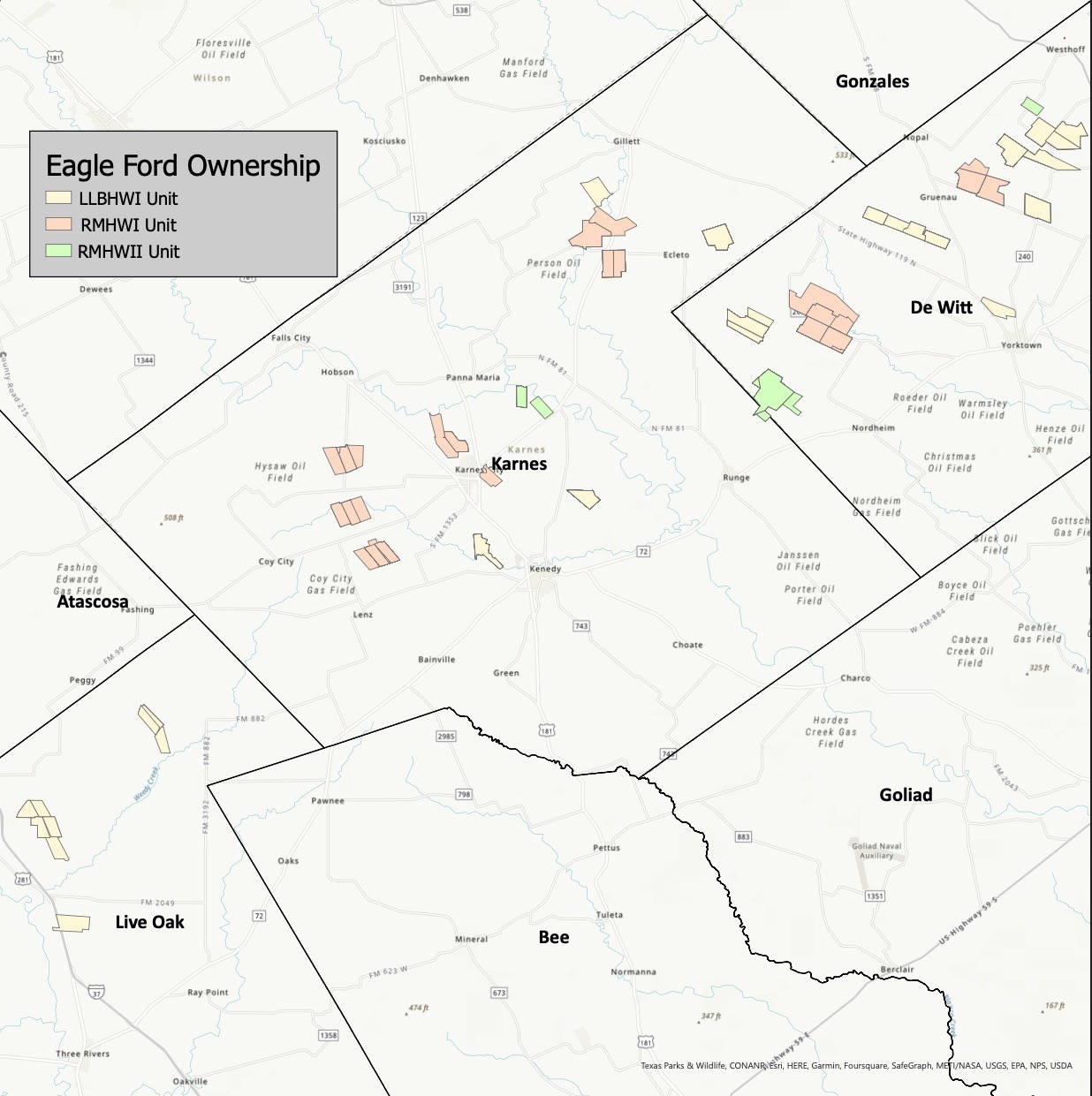

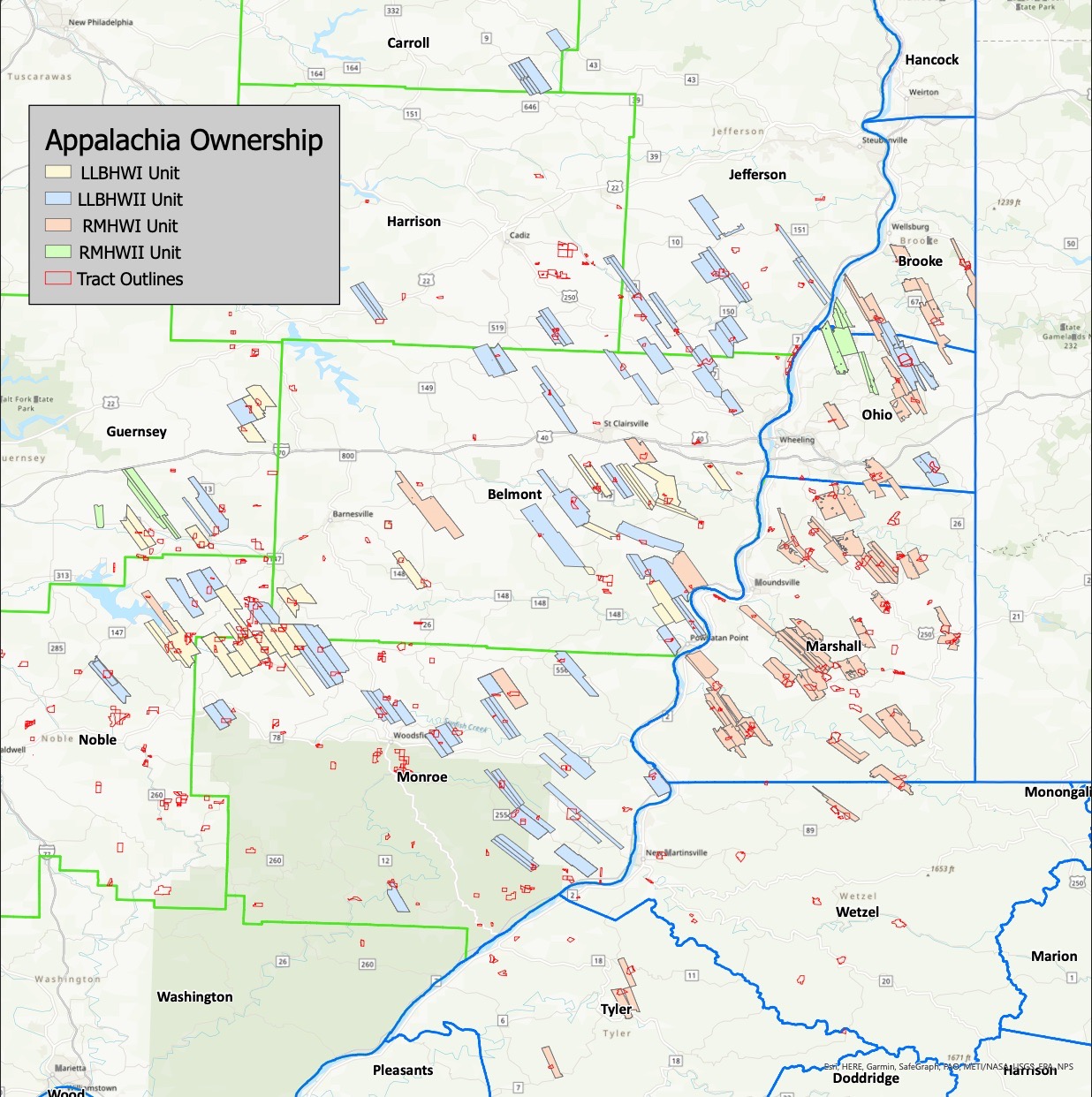

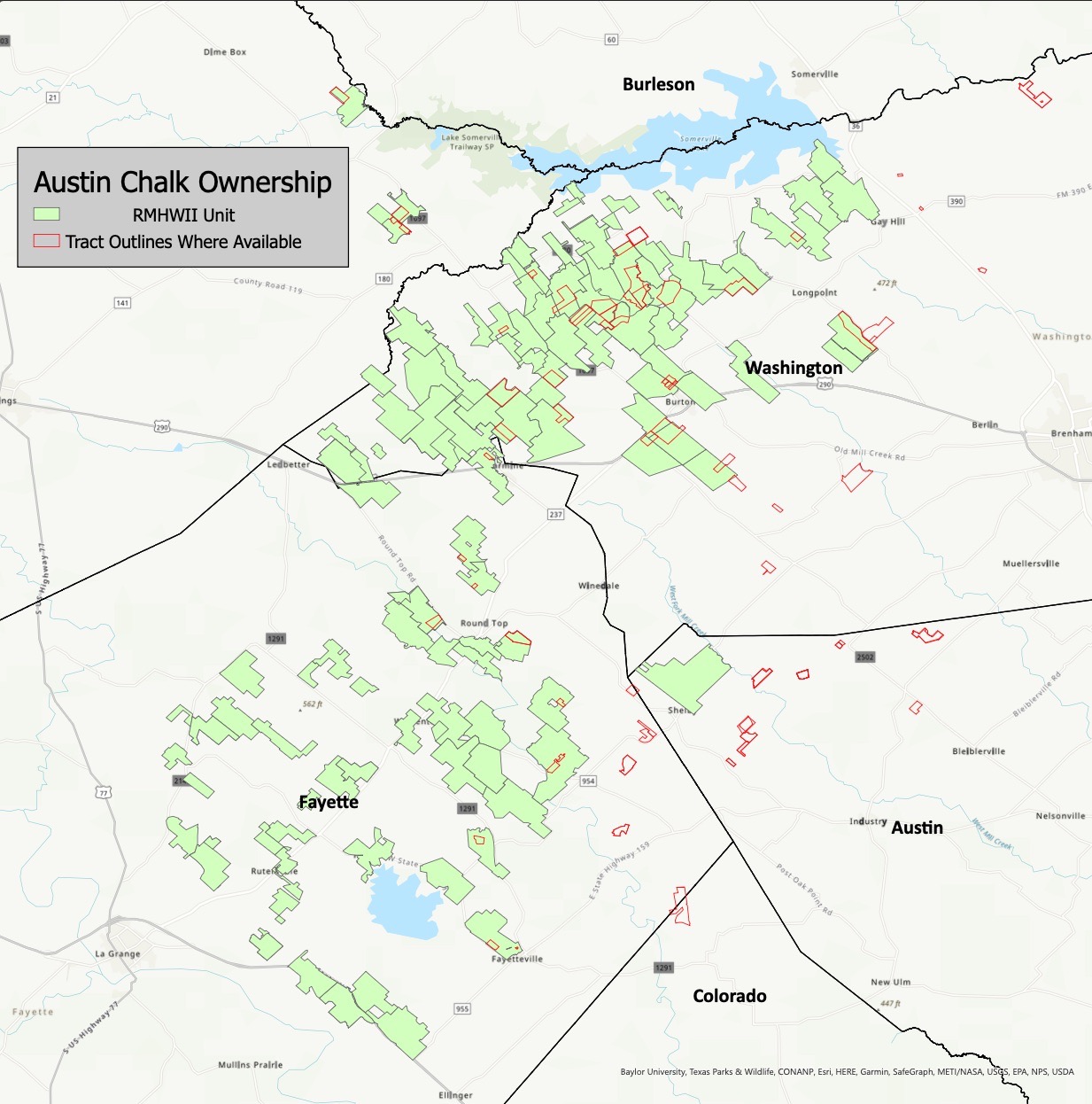

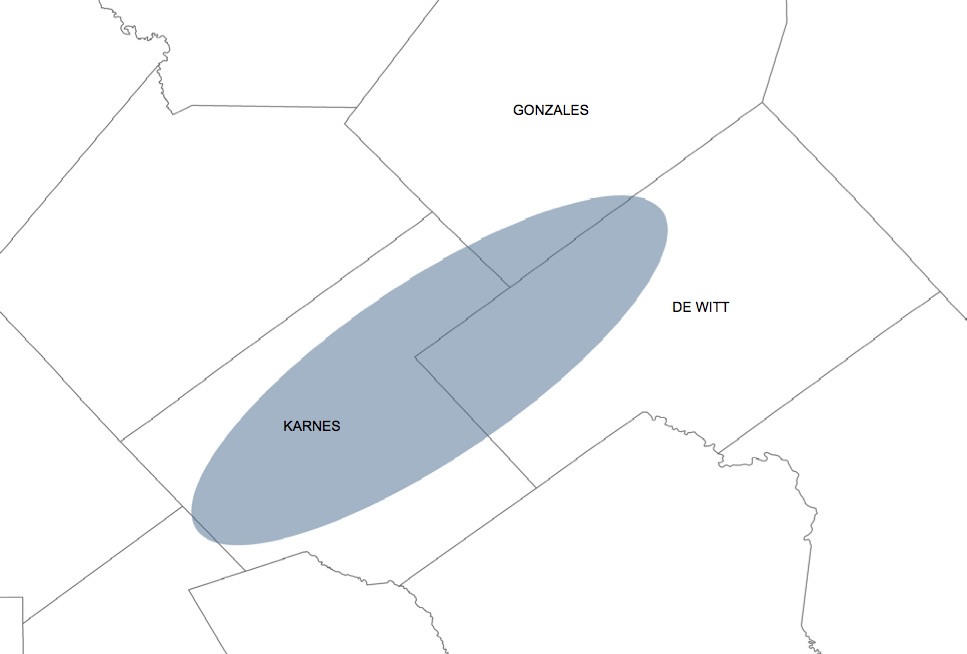

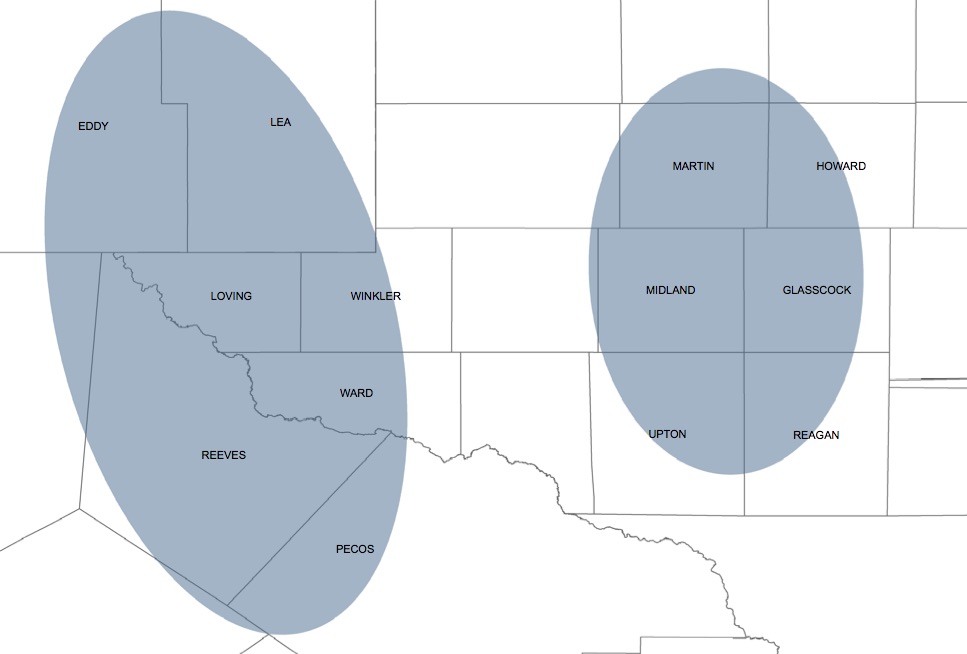

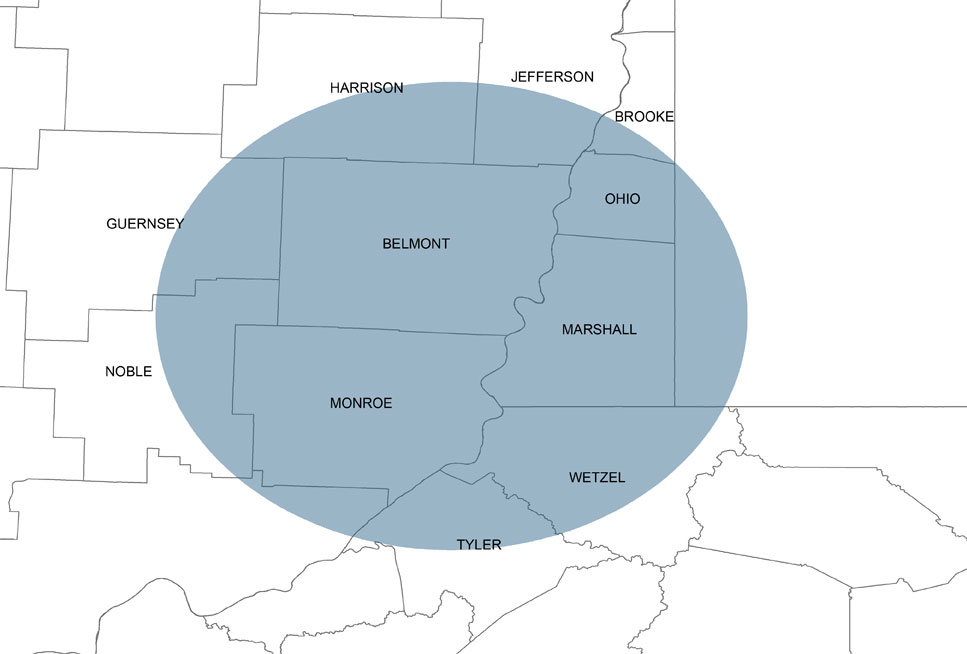

Our most desired areas are in the Eagle Ford Shale of South Texas, the Permian Basin of West Texas, and the Giddings Field of Southeast Texas behind West Virginia portions of the Appalachian Basin in Ohio and West Virginia. (See maps for reference.)

If you are a mineral or royalty owner in any of the described areas and want to consider a sale to Resource Minerals, we welcome an inquiry. We think you will find conducting business with our team very satisfying.

Asset Overview

The Team at Resource Minerals currently owns interests in and manages nearly 30,000 net royalty acres in the noted areas of interest. If you would like to see further detail on the specific counties or maps, please see our Partnerships Page.

Reasons to Sell

Revenue / Commodity Price Risk

There are a multitude of reasons a mineral or royalty owner may choose to sell some of their assets. Most commonly, we find that people don’t want to wait on an uncertain future. Periods of dramatically reduced oil and gas prices such as we experienced in late 2014 through 2016 significantly diminish cash flow for two main reasons. Most obviously, royalty payments drop when oil and gas prices drop which in the most recent downturn was up to 70%. Additionally, a drop in oil and gas prices halts new well drilling, which is key to future income from your minerals and royalties. These wells decline very rapidly, and without further drilling, income will decline rapidly as well. These cycles are unpredictable and one of the best ways to hedge against them is to sell all or a portion of your minerals.

Large Cash Payment Now

Many times, people are at a point in their lives when harvesting the cash value of minerals now is sensible. Mitigating future risk, advancing age, family needs, and financial stress are all reasons to consider a sale. A cash payout in many instances is a once in a lifetime opportunity for many individuals. This could facilitate a much more enjoyable retirement, fund college for kids and grandkids, or just improve quality of life for many. One of the more enjoyable aspects of our business is handing over a very large check to a family that can really use it!

Tax Advantages

Taxes – a mineral or royalty sale is a real property transaction and subject to capital gains taxation. If an owner has had title to minerals long enough, the sale is subject to long term capital gains. Capital gains tax rates are much lower than the upper levels of ordinary income tax rates. Even if a sale occurs at exactly the same amount of money as an owner would receive over time via royalties, the difference in tax rates can make the sale a much more profitable outcome. Please consult your personal tax professional for more details and advice on your specific situation.

Whatever your reasons for contemplating a sale of your minerals, we will do our best to accommodate your needs.

Steps Involved in Selling

If you are interested in exploring a sale of your mineral or royalty interest to Resource Minerals, the process is very simple.

- You may either click on the “Request an Offer” link or simply send an email to Tessa or if you are in the Appalachian Region, you may email our local field representative, Joel Lindenmuth.

- Alternatively, if you prefer to contact us by phone, you may reach Tessa at (512) 368-9429 x103, or Joel at (740) 260-0972.

- Please have a brief description of your property interest handy so you may include some specifics in the email or relate them to us over the phone. Important information includes your county, state, parcel or tract number, net acres, and if leased, name of operator and royalty percentage. If you need help interpreting the lease; we will be happy to review it for you.

Once we have the information required to formulate an offer, we will contact you back within 48 hours with an answer. Once we have agreed on a sales price, we will enter into a sales contract. This shouldn’t take more than a couple of days to complete. Since we are internally funded and don’t have to raise the money to close, or sell your deal to another buyer, all we need after a contract is time to properly evaluate the title. This is dependent upon how busy the courthouse is and the workload of our title crew, but typically no longer than 6 weeks. In certain circumstances, particularly on sales of mineral interests in well-established producing units we are able to close within a couple of weeks (Eagle Ford). We understand that sometimes a sale is necessitated by an immediate need for cash. We will do everything we can to accelerate the closing in these circumstances.